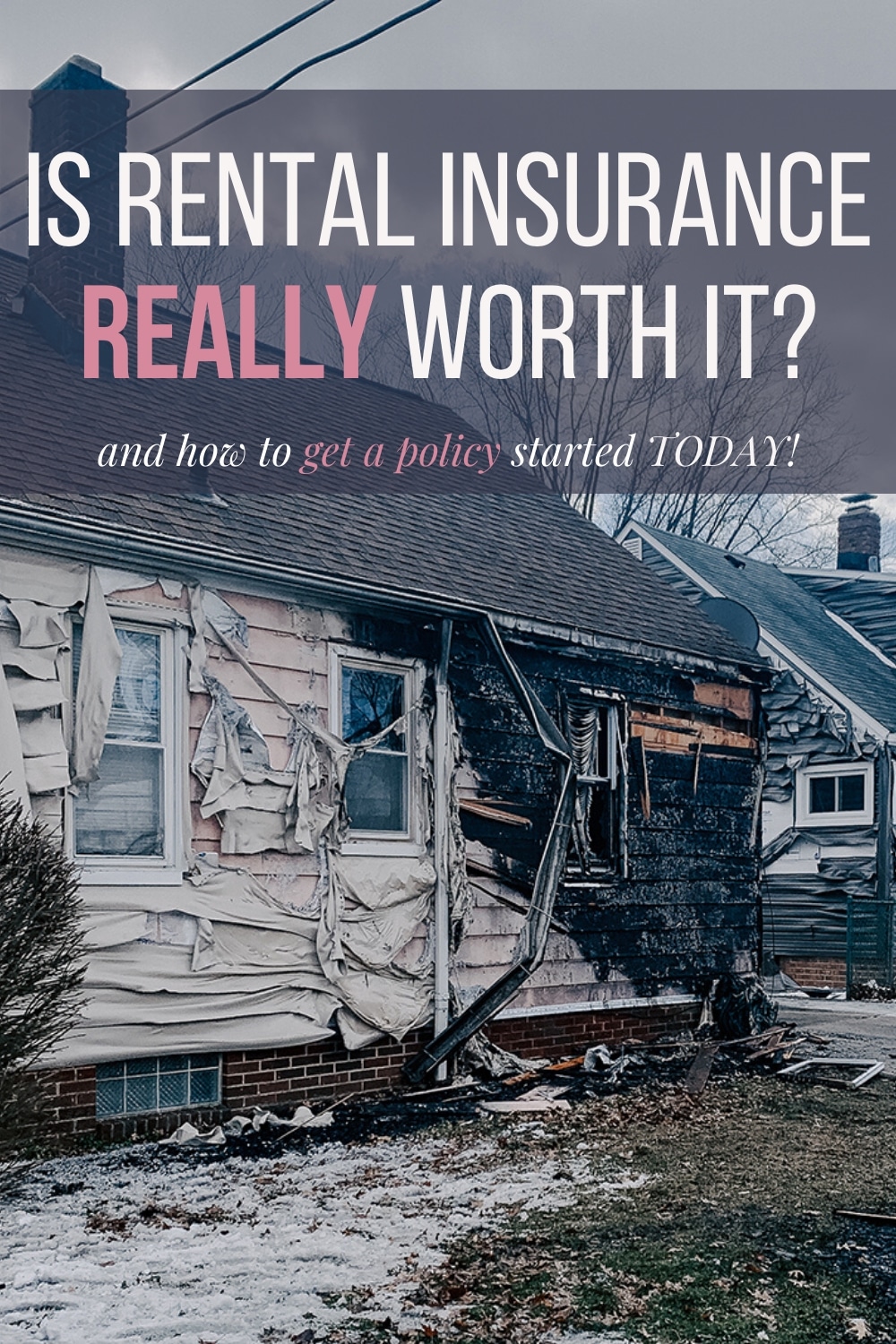

Rental Insurance Protects More Than Just Your Belongings + Why You Need a Policy In Place Today

Renter insurance is a minimal cost for the peace of mind it provides.

The links in this post may be affiliate links. That means that if you click them and make a purchase, this site makes a commission. It will have no impact on the price you pay or the experience of your purchase.

Every renter should have it.

Whether you have a lot of possessions or not, it is about so much more than just your belongings.

Insurance exists to help you prevent financial ruin in the event that an accident or loss happens.

There are a lot of misconceptions out there about rental insurance. And many people are renting homes and apartments without renters insurance because of them.

I’m not sure why exactly tenants go without renters insurance. But if I had to guess, I would say it has to do with two things – the thought that it really isn’t needed or the thought that it costs too much.

Perhaps people even believe that the landlord’s property insurance will cover their loss if the home experiences a fire or natural disaster.

I am here to tell you that none of the last three things are true.

What many people don’t know is that in addition to covering your belongings, there is such a thing as tenant liability insurance.

Meaning that if something happens and it is determined that you were at fault or the cause, the rental policy can cover the financial impacts of that to the extent of your coverage limits. I’ll explain more about what that means. So stay tuned.

While in college, I worked for one of the nation's top 3 insurance companies. Holding licenses to sell property and casualty insurance in more than 20 states. While I did not write homeowners' insurance, holding a property and casualty license, I could.

As a landlord, I recently experienced my first loss.

And the knowledge and experience I have gained from both of these are worth sharing. Especially if it can save you from unknowingly making a poor decision.

What is renters insurance?

Renters insurance is a type of insurance policy that provides coverage to tenants or renters for their personal belongings and liability. There are two parts to a good renters insurance policy – personal property coverage and liability coverage.

What is renter's personal property coverage?

This type of insurance can cover the cost of replacing or repairing personal property, such as furniture, electronics, clothing, and jewelry, if they are damaged, destroyed, or stolen due to covered events like theft, fire, or natural disasters.

In addition to personal property coverage, renters insurance typically includes tenant liability coverage.

What is tenant liability coverage?

Tenant liability coverage can provide protection if a tenant is held liable for damages or injuries to other people or their property while on the rental property.

For example, if a tenant accidentally causes a fire that damages the rental property or a neighbor's property, liability coverage can help cover the cost of the damages.

Some renters' insurance policies may also include additional living expenses coverage, which can help cover the cost of temporary housing if the rental property becomes uninhabitable due to a covered event.

It's important to note that renters insurance policies typically have limits and exclusions. This means that it will cover an event to the extent of the limits of the policy.

What Is The Purpose of a Renters Insurance?

A renters insurance policy will protect your possessions and sometimes other damage caused by a disaster that leaves you homeless or worse. But most importantly, it will protect your financial interest as well.

What Does Protecting Your Financial Interest Mean?

As a means to spread more awareness about renters insurance, I am sharing the importance of renters insurance, what it covers, and how you can go about getting renters insurance today!

When you become a tenant your landlord should advise you to get a renters insurance policy. Some places, like larger apartment complexes, require it and will charge you a fee, or put coverage in place for you (for a fee) if you do not have a policy in place.

Renters insurance is a type of property and casualty insurance. And it is much like your car insurance.

What is property and casualty insurance?

Property and casualty insurance (P&C insurance) is a broad category of insurance that provides coverage for risks related to property and liability. This type of insurance is commonly purchased by individuals, businesses, and organizations to protect against financial loss due to damage or loss of property, legal liability, and other risks.

Property insurance provides coverage for physical property, such as buildings, equipment, and inventory, against risks like fire, theft, and natural disasters. This type of insurance can also provide coverage for loss of income or other financial losses related to damage to the property.

Casualty insurance provides liability coverage for individuals or businesses in case of claims for bodily injury or property damage caused by the insured party. Examples of casualty insurance include auto insurance, general liability insurance, and professional liability insurance.

Some common types of property and casualty insurance include:

- Homeowners insurance

- Renters insurance

- Auto insurance

- Business property insurance

- Workers' compensation insurance

- Directors and officers liability insurance

- Errors and omissions insurance

The types of coverage included in a property and casualty insurance policy can vary depending on the policyholder's needs and the specific risks they face.

Rental insurance is only one type of P&C insurance, and it can protect you and pay for certain damages when an emergency situation arises like a fire, flood, or even a break-in.

As with all insurance, there are different levels of renters' insurance plans. You’ll want to review all of your renter’s insurance options and select a plan that suits your family’s needs best.

If you’re renting your current home, but don’t have renters insurance, then please continue reading the information I’m about to share. I want to make sure that all tenants all over the world understand why they should have renters insurance. And how to go about getting an insurance policy for their rental unit.

Who Should Have Renters Insurance?

Anyone who rents a property from someone else should have renters insurance. It doesn’t matter if you’re renting a condo, an apartment, or a house. The point is that renters insurance is there to protect and care for a person who’s renting a location as their primary residence.

The owner of the home should have a policy in place. One that protects their property and financial interest. And it is the responsibility of you as the tenant to protect your property and financial interest and liability.

Since renters insurance isn’t always required by landlords, many tenants go without it. Renters' insurance is relatively inexpensive and is best for anyone looking to live in a rental. Just as you should not drive a car without having automobile coverage, you should also not live anywhere without having some sort of coverage as well. Here are a few scenarios where renters insurance can help.

How Much Does Renters Insurance Cost?

Renters insurance has different premiums based on where you live and other conditions. But getting coverage is as simple as going online, or calling an agent to get a quote for renters insurance.

Based on my research the average annual cost of renters insurance is between $300 and $400. That breaks down to less than the cost of a good dinner monthly.

There are some renters insurance plans that cost more or less depending on the place where you live, the area it is located, and the coverage selected.

There’s usually an annual or monthly payment option with different insurance carriers. The monthly rate may cost a little more than paying for a year of renters insurance upfront. As with many things, paying in full yields a discount.

What Will Renters Insurance Cover?

The specific coverage included in a rental insurance policy can vary depending on the policy terms and the insurance provider, but generally, rental insurance covers the following:

- Personal property

- Liability

- Additional living expenses

It's important to note that rental insurance policies typically have limits and exclusions, so it's essential to review the policy carefully and consider additional coverage options if necessary. Additionally, rental insurance may not cover damage or loss caused by certain events or circumstances, such as floods or earthquakes, so renters may need to purchase separate insurance policies for these risks.

While each renters insurance policy can cover various items, the basic rule of thumb is to know that renters insurance will help you recoup financially from a fire or similar unexpected event that’s not your fault.

There are three parts to a rental insurance policy. Let’s talk about them.

Coverages of a Rental Policy

Personal property coverage

Rental insurance provides coverage for the cost of replacing or repairing personal property, such as furniture, electronics, clothing, and jewelry, if they are damaged, destroyed or stolen due to covered events like theft, fire, or natural disasters, up to the policy's limits.

Liability coverage

Rental insurance typically includes liability coverage, which can provide protection if a tenant is held liable for damages or injuries to other people or their property while on the rental property. For example, if a tenant accidentally causes a fire that damages the rental property or a neighbor's property, liability coverage can help cover the cost of the damages. It can also cover a guest’s medical bills if you’re found responsible for their injuries, up to the limits of your policy.

Additional Living Expenses

This covers additional costs related to a loss. Things like hotel bills, if the residence you rent is damaged to the point that you can not live there.

So, in addition to covering damaged or lost possessions, renters insurance can help cover the tenant's liability. For things like if a visitor is hurt on the property. In addition, it can help provide temporary financial help to have shelter after a disaster like a fire strikes the rental property, etc.

If you’re a tenant who wants to make sure you’re protected while renting, it’s important that you look into renters insurance. This is a worthwhile investment for anyone renting a residential property. Whether it is for a short or long term.

How You Could Be Liable?

In an accident, there is always a party that is at fault. Having been at fault does not mean it is intentional, but someone has to accept responsibility.

Because auto is a little more relatable, let’s start there with this example.

If person A and person B get into an auto accident and it is determined to be person A’s fault. Even if person B’s insurance company pays to get their client's car repaired or replaced, they will look to Person A’s insurance company to reimburse them for what they paid out as it was their client’s fault and ultimately their loss to cover.

This is why at minimum, all drivers are required to at least have liability coverage. This covers the damage or harm caused to others. Even if a person doesn't deem their own property as worth covering for repair or replacement.

The same is true when there is a loss at home.

If the place you live catches fire as a result of you leaving an electric heater on and unattended, then you can be seen at fault for the fire. While the homeowner’s policy will pay out to repair or replace the home. It is likely, they will go after you (or your insurance company) to pay back the damages that were covered.

Is rental insurance required?

Renters insurance is typically not required by law, but some landlords or property management companies may require tenants to purchase renters insurance as a condition of the lease agreement.

While renters insurance is not mandatory, I can not express enough how it can be a wise investment for renters to protect their personal property and provide liability coverage.

Even if renters insurance is not required by a landlord or lease agreement, it is still a good idea to consider purchasing a policy to protect against unexpected events and ensure peace of mind. Renters' insurance is often affordable and can provide valuable coverage for a range of risks.

What Happens If There Is A Loss, And You Do Not Have Renters Insurance?

When a person does not have insurance, they are still financially responsible for the part they play in an accident. Without insurance, it can lead to a lawsuit. A lawsuit can result in your wages being garnished, credit ruined, and/or other measures being taken to recover their money.

This is where financial ruin from an accident can happen.

On the flip side, if the house catches fire as a result of faulty wiring. And as a result, you lose all of your things. Your renters' policy will cover your belongings and such. But they may go after the homeowner (or the homeowners' insurance company). This is because it is their responsibility to upkeep the property and its components.

Can renters insurance be backdated?

No, renters insurance cannot be backdated. Renters insurance policies are written on a prospective basis and typically begin on the date the policy is purchased. The policyholder pays a premium for coverage that applies going forward, and the insurance company agrees to cover certain risks or events that may occur during the policy term.

Once the policy is in effect, the coverage cannot be applied retroactively to a loss or damage that occurred before the policy was purchased. In other words, renters insurance cannot cover an event that has already happened, as that would be considered insurance fraud.

Delaying the purchase of renters insurance can leave tenants vulnerable to financial loss. If an event occurs before the policy is in place, coverage will not be extended

How To Shop For Renters Insurance Online

You do not want to wait until something happens to find out the importance of having a rental policy. There should be a policy in place before you move into a new place.

To shop online, head to google. A quick search for shop rental insurance and many options to obtain a quote will come up for you.

You can also contact a local agent to shop for different companies for the best coverage and rates.

When should you get renter's insurance?

It's a good idea for renters to get renters insurance as soon as they sign a lease and before moving into a new rental property. The policy can be set to start they day that the lease begins.

Having renters insurance can provide peace of mind and help tenants avoid significant financial losses.

Here are some situations when you should absolutely consider getting renters insurance:

- Moving into a new rental property. As mentioned, it's a good idea to purchase renters insurance as soon as you move into a new rental property. This ensures that your personal property is protected from unexpected events from day one.

- Acquiring expensive personal property. If you acquire expensive personal property. Such as jewelry, electronics, or artwork. It's a good idea to purchase renters insurance to protect these items from loss or damage.

- Renting a property in an area prone to natural disasters. If you rent a property in an area prone to natural disasters, such as hurricanes, earthquakes, or floods. It's important to have renters insurance to protect your personal property from damage or loss caused by these events.

- Hosting guests in your rental property. If you frequently have guests in your rental property, it's a good idea to have liability coverage. This helps to protect yourself from liability claims if a guest is injured on your property.

If you have any additional questions that this article does not answer for you please drop them in the comments below. I will be sure to respond and update the article as needed.

Please click one (or all) of the share buttons below and share this with others who may not know what they do not know.

It's really simple, and the message is already crafted for you to make it that much easier!

TK, I’m so sorry for you and your tenants loss. Thanks for educating us on this matter.

Thanks Ron! I appreciate it.